WhatsApp)

WhatsApp)

Customs and Excise Duties PART II Customs and Excise Duties 3.(1) Subject to any exemption or rebates provided by or under the authority of this Act, there shall be raised, levied, collected and paid for the use of the Government, the customs duties, in respect of goods imported into Belize, or

This post will list out the current cost of clearing cars in Nigeria Tin can port, Cotonou(Seme Border), Apapa Port and other ports to deliver them to a client in Nigeria. Charges such as Nigerian custom duty charge on imported cars, port charges and clearing agent charges will also need to be paid for this [.]

The customs duties and VAT payable will be calculated based on the rate of duty dictated by the specific tariff code. Failure to correctly classify goods within the tariff book could result in either under or over payment of Customs Duties and ValueAdded Tax (VAT) on importation.

The rate of duty you are liable to pay may be differ if you are importing from one of the below countries (see page 2). A certificate of origin (Eur1 or SADC certificate) will need to accompany your imported goods in order to qualify for any beneficial duty rates. Import Duty Tax Look Up 1.

Consumption and excise duty is applicable to: the production in the Democratic Republic of the Congo of consumer goods subject to duty and; the import of these products to the Democratic Republic of the Congo. Consumption and excise duties accrue on imports, as do customs duties and VAT.

Our nigeria import data solutions meet your actual import requirements in quality, volume, seasonality, and geography. Alongside we help you get detailed information on the vital import fields that encompass HS codes, product description, duty, quantity, price etc.

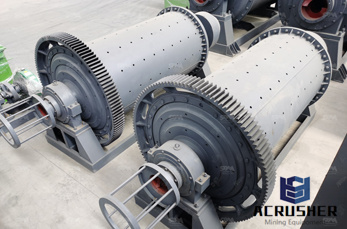

Custom procedures, ... All other items under the Mining List will attract 5% Import Duty 6. ECOWAS LEVY (%) ... Machinery, plant and apparatus and spare parts for agricultural purposes.

Import Duty and Sales Tax Exemption on Imported Raw Materials Version and Machinery – Process and Procedures Dated 1 September 2009 5 Import Duty and/or Sales Tax Exemption on Raw Materials and Components for the Manufacturer of Finished Products For applicants involved in manufacturing or agricultural activities and

Import Duty is calculated on the Cost Insurance and Freight (CIF) value of the commodity whilst Import VAT is calculated on the DutyInclusive value of the goods. It is important to note that different rates of Duty apply to all imports whereas VAT is a flat rate.

Customs duties (including additional ad valorem duties on certain luxury or nonessential items) Antidumping and countervailing duties; VAT (which is also collected on goods imported and cleared for home consumption). Antidumping and countervailing duty

LIST OF CONDITIONAL DUTY EXEMPTIONS I FOR INDUSTRY, FORESTRY AND MINING A. Machinery and equipment, and materials for use in approved industry, and parts thereof, forestry and mining (including the exploration, exploitation and storage of .

USA Customs Import and Export Duty Calculator. Goodada''s USA customs import and export duty calculator will help you identify the export tariff rates you will pay for the USA. By providing our team of brokers with several pieces of key information, we can determine the rates due and assist you in .

First, note that goods arriving in the country may be subject to import duty, special duty, VAT and import excise duty. Ghana import duty is assessed based on volume, weight or value of an item, and is subject to change every year. Import duty rates range from 0%, 5%, 10% and 20%, and the fees are collected by the Ghana Customs Division.

Check car import duty of over 5000 cars in Nigeria at no cost, its totally free . Proudly brought to you by the No 1 auto blog in Nigeria Autojosh

All along the way, there are various things of which you''ll need to be aware. Below, we''re going to review everything that you need to know about importing used and salvage vehicles from the United States to Nigeria. Buying a Used or Salvage Car at a Auction

Jun 17, 2019· This should serve as a guide for you to have an idea how much the cost of clearing cars in Nigeria is. Hence, when you hire a clearing agent, The Clearing agent will apply for customs valuation to get the correct value charge for your vehicle Latest Cost of clearing cars in Nigeria 2018 (Price List) Cost of Clearing Acura Vehicles . Acura ILX 2009

The import duty rate for importing New motor spare parts into Nigeria is 10%, the import VAT is 0%, when classified under Car Parts Accessories → Motorcycle Parts Accessories → Motorcycle Parts Accessories | other with HS commodity code

Goodada Helping South African Importers and Exporters with their Duty Taxes. Most goods imported or exported are subject to South African Customs Duties. A complete import and export declaration form must be completed which our South Africa Customs Broker can assist you with.

Cigarettes levy is charged at rates between 50% and on the sum of the CIF value and duty. Sugar levy. Sugar levy is charged at rates between 10% and 20% on the sum of the CIF value and duty. Import Duty Rate. The duty rates for importation in Nigeria ranges from 0% to 35%, with an average duty .

Welcome to the Website of the Nigeria Customs Service. We sincerely hope that the global trading community, travellers and other stakeholders will find the information provided through this medium useful and timely. Dynamics of Technology have changed the conduct and scope of international trade.

Aug 11, 2007· Please let me know the what is the Percentage of custom duty on import of Books in Ghana? ... Can you let me know if commodity code 87,01,30,00,00 would be correct to use on the import of Mining Tractor parts into Ghana. Thanks. 18. ... what are the things that are expensive in Ghana but cheap in Nigeria? and the possible import duty on them. 29.

LIST OF CONDITIONAL DUTY EXEMPTIONS I FOR INDUSTRY, AGRICULTURE, FISHERIES, FORESTRY AND MINING A Machinery and equipment, including equipment for the transportation of goods, and materials for use in approved industry, and parts thereof, agriculture (including livestock),

Calculate Customs Duty using duty calculator for 100+ countries including VAT and other taxes like excise duty etc.

The Customs EDI gateway and related functionality will not be impacted. Customs and Excise clients are asked to take note of the following specific details: 1. Customs Supporting Documents submission (web service) It will not be possible to upload Customs supporting documents electronically during the system migration.

WhatsApp)

WhatsApp)